About:

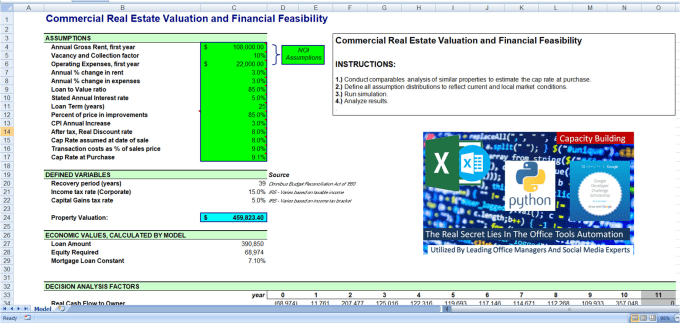

So you’ve read finance articles and you already understand the fundamentals of personal finance such as budgeting income and expenses. What should you do next?

Now it’s time to design a long-term personal financial plan that you can implement through your various life stages because…

- Saving through "traditional" means is not enough

- Flipping stocks with some “play money” is not a long-term reliable plan

- Retiring off your life savings may not be enough if you live a long life

- Relying on your personal or retirement savings to fund large unexpected expenses is risky

- You currently have or may have dependents in the future to look after

- You need both a starting and exiting strategy

- And more...

Let’s rediscover some truths and debunk some myths. A customized, holistic financial needs analysis is good for:

- New immigrants

- Young individuals, professionals, or families planning for their financial future

- Individuals who want to find out “What the banks don’t want you to know"

- Small business owners

A written report will be delivered. Phone/web call available at no extra cost. Please read FAQ section before sending order.

Reviews

:

John has given me an overall view of short-term and long-term personal plans. Some of that info was new and helpful. Thanks

:John provided us a great financial report which will help us make better decisions in a short and long run.

:Great work, very detailed!

:Fantastic thank you!

:Great work ! V detailed !